The final rule announced by the Biden administration on Tuesday will prevent unpaid medical bills from appearing on credit reports. This can make it difficult for people to get a small business loan, mortgage, or car loan.

The Consumer Financial Protection Bureau reports that the rule will remove $49 billion in medical debts on the credit reports of more than 15 million Americans. Lenders will be unable to take into consideration this information when deciding whether or not they will grant a loan.

According to the Bureau, this change could lead to an increase in mortgage approvals of up to 22,000 per year.

Vice President Kamala Harris said that the rule “would change lives” for millions by making it easier for them to get a mortgage for a home, vehicle, or small business loan. This historic rule will enable more Americans to create wealth, save money, and thrive.

She stated that no one should have their economic opportunities denied to them because they are sick or in a medical emergency.

Reuters reported that the announcement on Tuesday was made despite Republican demands that Congress stop the Biden administration from issuing any new regulations, as Donald Trump prepares for his inauguration. That means that he or his congressional allies may attempt to reverse this prohibition.

Jaret is an analyst with TD Cowen Washington Research Group. She stated that Team Trump could try to reverse these actions or freeze them, but this is not guaranteed. It is for this reason that removing the prohibition against including medical debts in credit reports or dropping an enforcement action against one credit bureau might be a lesser priority. “

Harris said that states and local governments used a comprehensive pandemic aid package in 2021 to eliminate more than $1 billion of medical debts for 700,000 Americans.

According to the announcement by the administration, the rule will go into effect in the fall of 2023.

The CFPB says that medical debts are a poor indication of an individual’s ability to repay a home loan. Last year, they announced that medical debts below $500 would be removed from consumer credit reports.

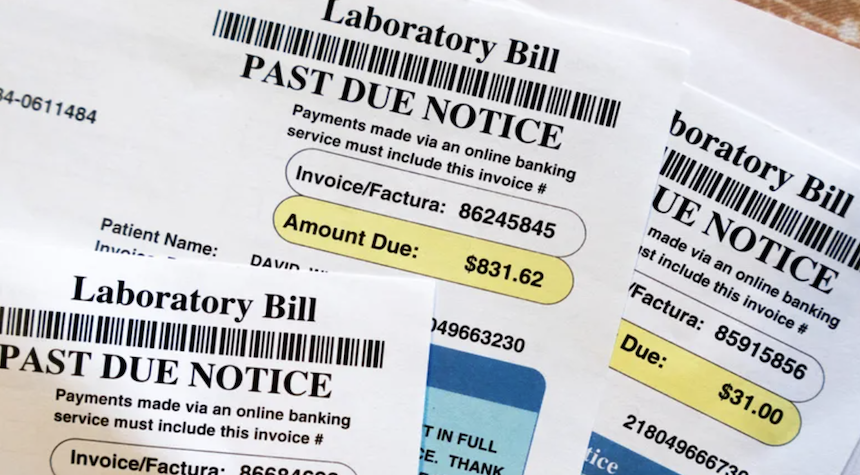

Chuck Bell, Consumer Reports advocacy program director stated in a release that “Medical Debt is a burden to millions of Americans. It can negatively affect a person’s history and make it difficult for them to obtain a loan, get a job, or rent an apartment. ” Many consumers are unable to get a loan, a job, or rent an apartment because they have incorrect medical debt on their credit reports.

Biden’s administration announced a new rule to address unpaid bills that appear on credit reports.